On January 17th 2017, CMHC mortgage insurance agency announced that their mortgage insurance premiums will be increasing starting March 17, 2017.

Over the past 2 years we have seen a number of changes to the mortgage borrowing regulations. This CMHC insurance premiums increase is another change to mortgage borrowing process and rules.

According to the CMHC agency an average increase in premiums for the homeowners will be insignificant. Roughly $5 per months increase on average.

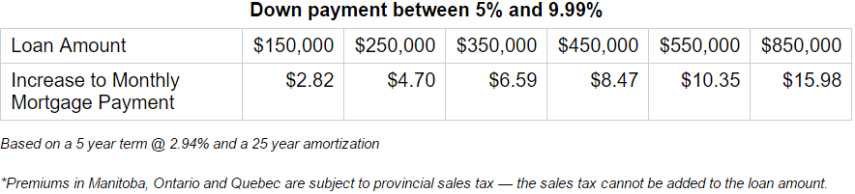

However, this increase will vary significantly depending on the mortgage amount. Home-buyers who have a $250,000 mortgage will see a $4.70 per month increase. Average Canadian insured mortgage is about $245,000. The monthly increase in premiums on mortgages of $150,000 will be $2.82.

In Greater Vancouver, home-buyers are very likely to see higher average payment increases, as the average mortgage in the region is above that of the Canadian average. The CMHC said that the increase on loans of $450,000 would be $8.47 per month, and nearly $16 for those with insured mortgages of $850,000.

Roughly two-thirds of home-buyers with a CMHC-insured mortgage have down-payments of less than ten per cent. For most new home-buyers the monthly payment increase will be “negligible,” said Steven Mennill, CMHC’s senior vice-president of insurance.

Steven Mennill said, “We do not expect the higher premiums to have a significant impact on the ability of Canadians to buy a home. Overall, the changes will preserve competition in the mortgage loan insurance industry and contribute to financial stability.”

The CMHC’s statement said, “Capital requirements are an important factor in determining mortgage insurance premiums. The changes reflect OSFI’s new capital requirements that came into effect on January 1 of this year that require mortgage insurers to hold additional capital. Capital holdings create a buffer against potential losses, helping to ensure the long term stability of the financial system.”

From my experience this increase in the CMHC insurance premiums should not have any significant impact on the Metro Vancouver real estate market. I think that first-time home-buyers are the ones who most likely be effected by these CMCH premiums increase.